POLITHEOR

European Policy Network

finance

- Home

- finance

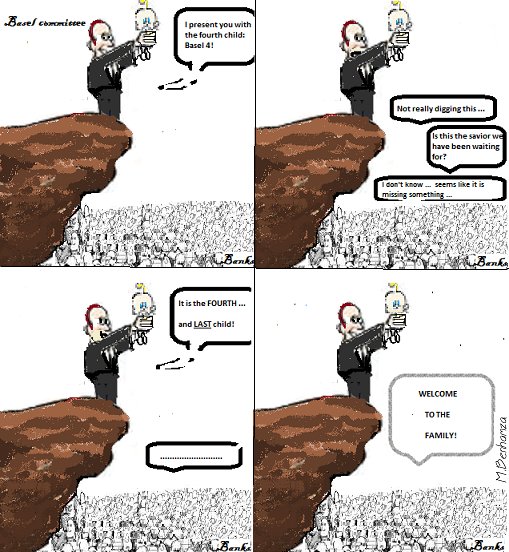

Basel 4 and European banks, are we safer now?1

- Financial Policy and International Markets, Op-ed

- 22/01/2018

The Basel Committee on Banking Supervision (BCBS) has recently agreed on a new set of rules with more restrictive requirements for the banking sector. These provisions will force European banks to converge to standardised risk-weighting of their assets by 2027 and should create better harmonisation of international capital requirements.

READ MORE

Global financial governance: does the EU have a say?0

- Financial Policy and International Markets, Op-ed

- 28/02/2017

As the EU tries to create a single financial market, engaging in a global financial governance which is no longer preoccupied with the development of new standards and institutions but rather concentrates on the implementation of existing rules, can the EU still play a major role in this particular scene?

READ MORE