POLITHEOR

European Policy Network

EU

- Home

- EU

Making nature count: What can the EU do?0

- Environment and Energy, Op-ed

- 10/03/2018

How much would it cost if we had to pay for the clean air that forests provide? For the groundwater filtered by natural soils? For the beautiful setting of the ocean when on holiday? How would businesses and national economies compare if we looked beyond the GDP, towards intangible environmental services? Natural Capital Accounting (NCA) has the answers, but its pioneers need to communicate what it’s all about to ensure implementation.

READ MORE

European Monetary Fund: further integrating financial stability0

In December 2017 the European Commission published its proposal for the establishment of a European Monetary Fund (EMF) that should prevent a re-run of the 2010-12 sovereign debt crises. The proposal is part of a wider reform debate which could potentially lead to a revision of the EU fundamental Treaties. Nonetheless, member states still hold different positions on the matter and squaring the circle of their diverging interests will be a tough task.

READ MORE

Ending money laundering in Europe: Does the “beneficial owner register” deliver?0

- Financial Policy and International Markets, Op-ed

- 22/02/2018

On December 6th last year, Luxembourg announced the draft law regarding beneficial ownership registration which will implement articles 30 and 31 of the Fourth Anti-Money Laundering Directive into the national legislation. By introducing such a law, the European Directive 2015/849, otherwise known as the Fourth Anti-Money Laundering Directive, tackled a serious problem in the fight against tax evasion and money laundering. The ultimate question: how much money is being hidden away?

READ MORE

Are we moving forward? – A new-generation of trade agreements for the EU0

- International Trade, Op-ed

- 05/02/2018

A reform of trade and investment agreements has been undergoing over the past ten years. While these agreements used to focus solely on facilitating the movement of goods and capitals, their scope is wider today and covers contemporary issues. The European trade policy also evolved and gave birth to a new-generation of free-trade agreements such as the ones concluded with Singapore, Canada or Vietnam. Several factors drove this wave of reform towards a more comprehensive approach to trade and should lead to further improvements.

READ MORE

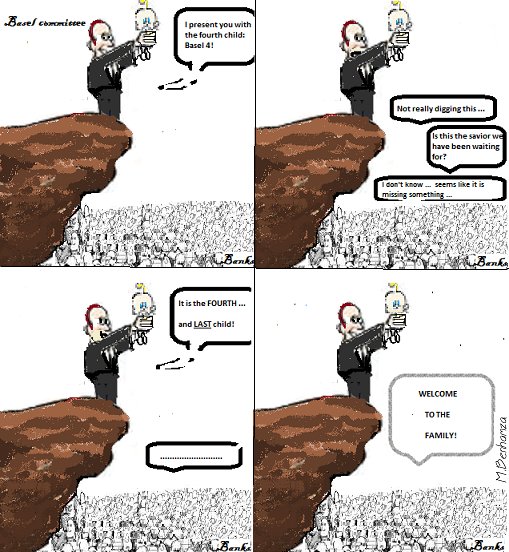

Basel 4 and European banks, are we safer now?1

- Financial Policy and International Markets, Op-ed

- 22/01/2018

The Basel Committee on Banking Supervision (BCBS) has recently agreed on a new set of rules with more restrictive requirements for the banking sector. These provisions will force European banks to converge to standardised risk-weighting of their assets by 2027 and should create better harmonisation of international capital requirements.

READ MORE